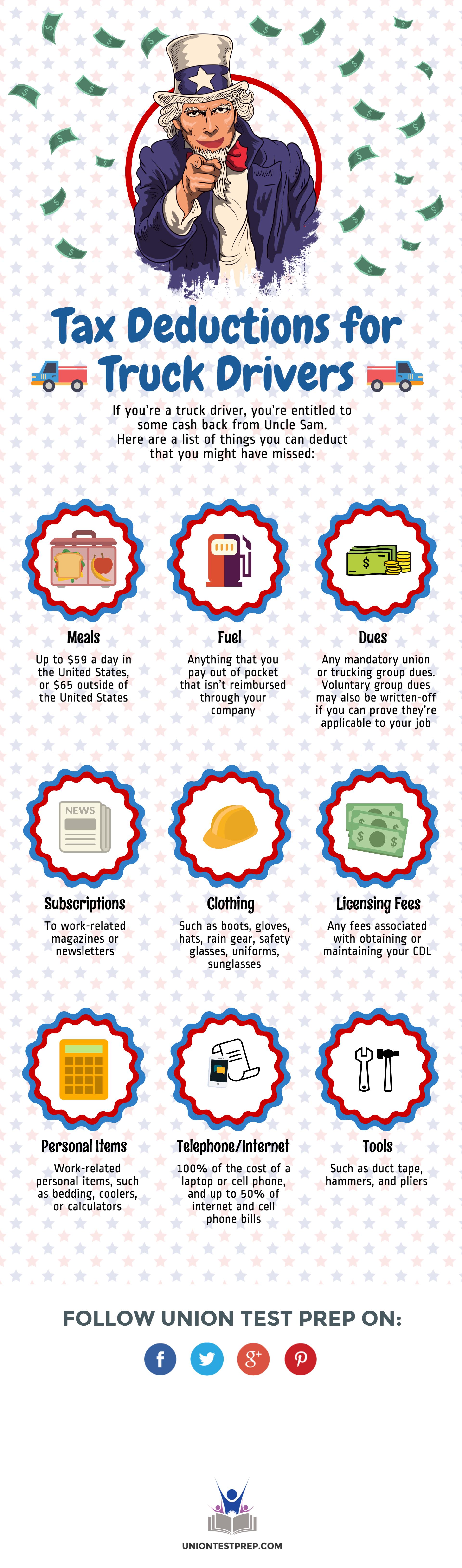

Tax Deductions for Truck Drivers

If you’re a truck driver, you’re entitled to some cash back from Uncle Sam! Here are a list of things you can deduct that you might have missed:

Meals: Up to $59 a day in the United States, or $65 outside of the United States

Fuel: Anything that you pay out of pocket that isn’t reimbursed through your company

Dues: Any mandatory union or trucking group dues. Voluntary group dues may also be written-off if you can prove they’re applicable to your job.

Subscriptions: To work-related magazines or newsletters

Clothing: Such as boots, gloves, hats, rain gear, safety glasses, uniforms, sunglasses

Licensing Fees: Any fees associated with obtaining or maintaining your CDL

Personal Items: Work-related personal items, such as bedding, coolers, or calculators

Telephone/Internet: 100% of the cost of a laptop or cell phone, and up to 50% of internet and cell phone bills

Tools: Such as duct tape, hammers, and pliers

Keep Reading

Commercial Driver's License Test Blog

How Many Questions are on the CDL Permit Test?

Embarking on a career in commercial truck driving begins with a crucial…

Commercial Driver's License Test Blog

What are the Three Tests for the CDL Permit?

If you’re looking to embark on a career in truck driving, obtaining a C…

Commercial Driver's License Test Blog

How Much Does It Cost to Get a CDL?

The trucking industry dominates freight shipping. Trucks handle over 70…